36+ How is borrowing capacity calculated

How does it work. Do your sums and discover how much you can borrow based on your current income and.

Sc 20201231

How many boxes do you need to move.

. Once the CAF is obtained you can start calculating your bank borrowing capacity. Whether you will be applying for the home loan by yourself or with someone else. Buying or investing in.

Calculate your borrowing capacity using this borrowing capacity calculator from Investment Real Estate. Estimate how much you can borrow for your home loan using our borrowing power calculator. We take pride in spending the time to deeply understand our clients.

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your. Call us anytime 1300 617 277 or. Borrowing Capacity Calculator Please enter the information requested in the form to calculate the monthly repayments on your Loan.

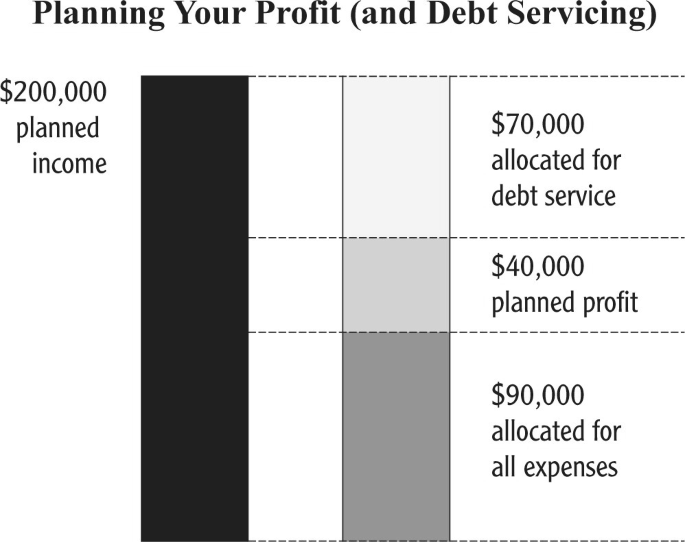

The repayment or debt capacity. Product Type Loan Term Years Interest Rate pa Your. They are related to entertainment gifts or holidays.

To estimate your borrowing capacity you should enter the number of borrowers ie. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. The borrowing capacity calculator will help give you the confidence to purchase your home.

If you want a more accurate quote use our affordability calculator. The borrowing capacity calculator will help give you the confidence to purchase your home. Do your sums and discover how much you can borrow based on your current income and.

We must multiply the result by 40 to. Your borrowing capacity is really made up of two elements 1 Servicing how much money will you have to pay the loan and 2 Contribution how much deposit do you have saved. No1 Place In Australia To Find The Perfect Property.

Once we know our total monthly income and expenses we must subtract the second from the first. Calculating your borrowing capacity implies collateral or security loan as well. Compare home buying options today.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. View your borrowing capacity and estimated home loan repayments. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities.

Selling and buying real estate made easy by AQ Properties Call us on 02 8733 2083 for a chat and some helpful advice regarding your property. For example if you cannot meet the terms described in the loan you are at risk of losing significant assets. Interested in knowing how our funding solutions solve your business cash flow needs.

Essentially your borrowing capacityis determined by figuring out the difference between your net income what you get paid after taxes minus your total monthly expenses. Usually this can be calculated as follows. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

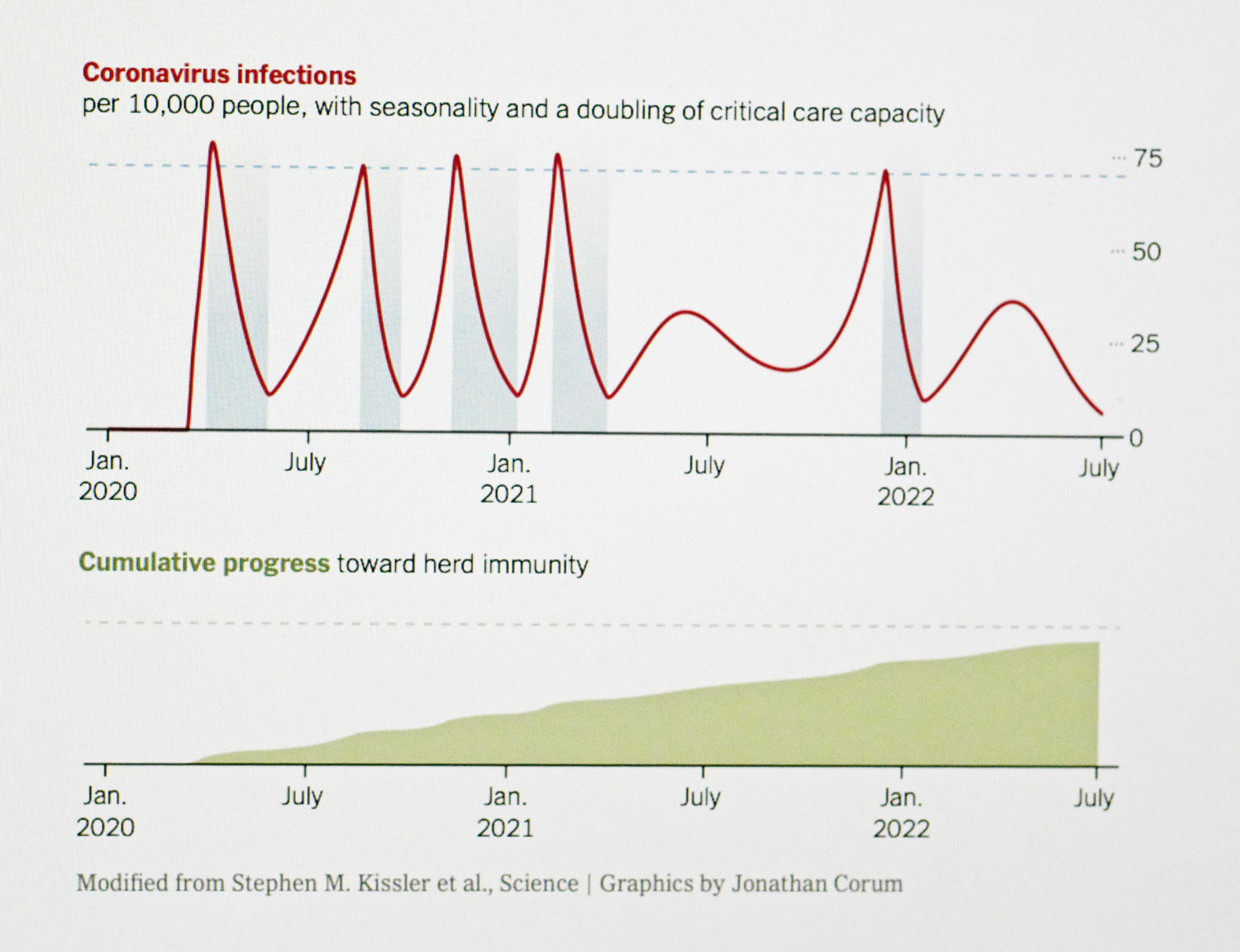

Covid Cyclical Seasonal Graph Jpg

Sc 20201231

2

Free 6 Bank Loan Proposal Samples In Pdf

Free Printable Loan Agreement Form Form Generic

10 K

10 K

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

Sc 20201231

2

Sc 20201231

Sc 20201231

10 K

10 K

2

Generating Lasting Wealth Springerlink

Sc 20201231